If you haven’t jumped on the Gold, Silver, and Platinum bandwagon yet, then get ready for a rollercoaster ride starting in the first trading day of 2026.

And In Case You Missed it…the precious metals went on a tear in 2025.

As usual, gold got most of the attention.

But all that glitters is not necessarily gold.

Because the results for 2025 show gold rising an impressive 66.23%.

Silver, however, blew the doors off gold by rising 143%.

Meanwhile, Platinum (who everybody and their brother ignores) increased 131.54%.

Any way you look at it, Gold, Silver, and Platinum smoked all traditional and non-traditional investments in 2025…including (2024’s best performer) Bitcoin, Nvidia, and everyone’s favorite sector AI.

So, what has caused the Metals Madness we are seeing?

If you’ve been reading our posts for any length of time you know how we have repeatedly said gold and silver are poised for a sling-shot move because global conditions had fundamentally – and perhaps irreversibly – shifted.

Not surprisingly, would-be gold haters also understand this.

Adding gasoline to that fire, we repeatedly said that the primary factors driving gold prices include:

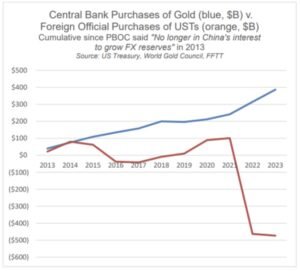

- Shifting geopolitics prompting central bank stockpiling

- Investor concerns over the creditworthiness of the U.S. government (Cough! the dollar)

- Persistent inflation eroding the purchasing power of paper currencies

- And widening supply-demand imbalances.

Ironically (or NOT) these factors will most likely increase in 2026.

Gold, Silver, and Platinum

As a result, we expect precious metals—including gold, silver, and platinum—to continue performing well in 2026.

Other not so obvious factors (overlooked by most) include Deglobalization and the continued push toward resource nationalism and the protection of critical materials.

(Cough! Rare earth minerals, Cough! Cough!)

These also lend additional support not only to these metals but also to the broader commodities complex.

Translation: We are in the early stages of a HUGE Commodity Cycle BOOM…with the metals leading the charge.

To further illustrate that point, very few investors even consider the fact that the Multi-Trillion-Dollar build-out of AI will demand an abnormal amount of energy to power it.

And in Case You Missed it…Silver – which happens to be in short supply – is used in all electronic devices we humans use on a regular basis.

So, if you’re still on the sidelines about buy precious metals, we suggest you read our FREE Special Report, Gold, If You Don’t Hold it, You Don’t Own it” (HERE).

And if you want to venture into mining stocks, we have plenty of recommendations in our Monthly Newsletter (HERE).

P.S. To answer the question: How long will the metals continue to rally? We simply say: The rally will continue until Cramer says to buy.

Share this with a friend…even if they refuse to believe that a major trend is in play in commodities. They’ll thank YOU later.

And tell them: