The BRI is not another annoying Wall Street Acronym.

It stands for Belt and Road Initiative.

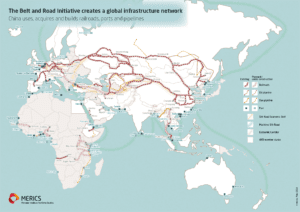

And it’s China’s most ambitious plan to recreate their famous “Silk Road.”

Historically, it was the most dominant trading route connecting Asia with Europe and Africa dating back to the Han Dynasty in 206 B.C.

Try to imagine a massive geographic area covering over 65 countries.

These countries include two thirds of the world’s population and over one third of the global GDP (Gross Domestic Product)…see map below.

The economic impact of the BRI is mind-boggling.

It’s establishing China as the major powerhouse of the 21st century.

You need to be paying attention to this.

As an investor, it affects all markets around the world.

Translation: lots of opportunities.

In addition to the massive shipping capabilities, infrastructure build-out of railways and highways of the New Silk Road, China’s BRI is also covering the oceans passage ways with their Maritime Silk Road.

This will assure China’s complete dominance for the future.