For over a decade the Goldbugs have been screaming that gold will rise to $20,000 per ounce. And now that gold is over $4,000 is this the melt-up they’ve been waiting for?

It sure looks like it.

Look at the numbers.

So far in 2025, the price of gold is up over 50%.

At the same time the price of many gold stocks is up over 100%.

Ironically (or NOT) much of that upside has taken place in the face of continued paper currency debasement and uncertainties over global trade and fiscal stability in the US.

Translation: As we have said MANY TIMES in the past; Gold is a barometer of fear.

Gold’s rally is on pace for its best annual performance since the 1970s.

And for those old enough to remember the 70s was a decade when soaring inflation and the end of the gold standard sparked a 15-fold rally of the precious metal.

So, do the math.

If history repeats, a 15-fold rally in gold would cause the price of gold to rise above $40,000 per ounce.

But let’s not get too crazy here…yet.

However, you cannot deny the momentum shift, especially from the Big Boyz and Central Banks purchases recently.

In an email last month, we wrote:

The $3,600 level on gold has been breached, setting the tone for $4,000 in the not-too-distant future.

And the gold bugs are partying like it’s 1999.

READ: Another All Time High for Gold, Again (HERE)

Gold is Over $4,000

Keep in mind that it took a long time for gold to break the $2,000 barrier…a much shorter time to break the $3,000 barrier and a much, MUCH shorter time to break the $4,000 barrier.

Translation: $5,000 is already baked into the cake.

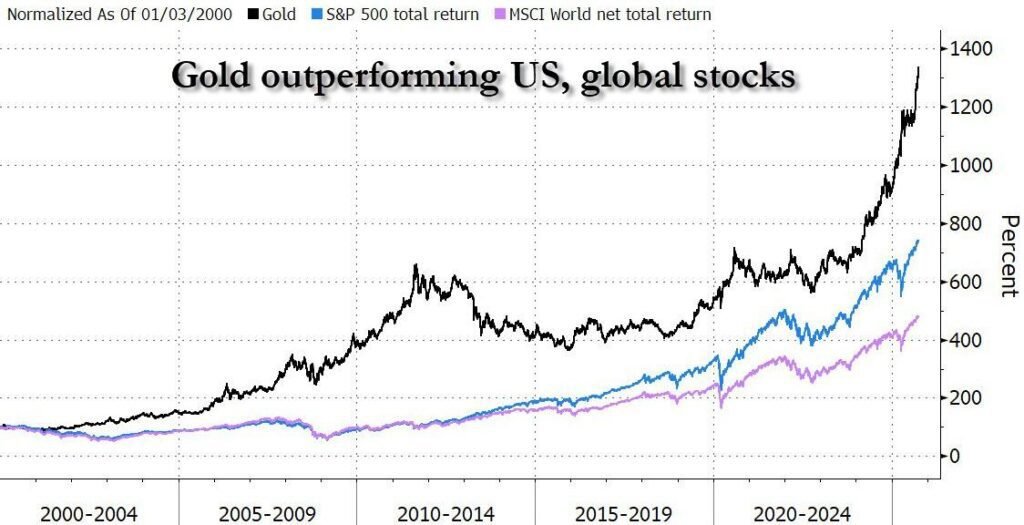

Meanwhile, the gold haters are slowly coming to the realization that we’re looking at a milestone moment here for the precious metal that traded below $2,000 just two years ago…with returns that now well outstrip those for equities in this century. (See Chart below)

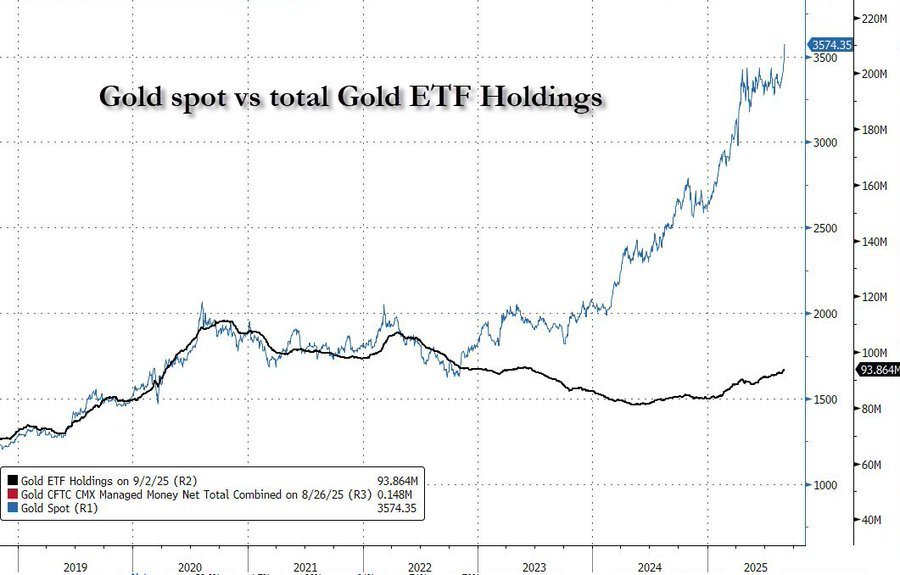

And when you realize how impressive that is, wait until you see how it moves when the ETFs start chasing gold and gold stocks… (See Chart Below).

Once again, we bring this to your attention because it is another illustration of what we have been saying for years about how most investors DO NOT HAVE ANY GOLD IN THEIR PORTFOLIO…YET.

Adding gasoline to this fire is the fact that 75% of all investment advisors (the ones you think should know better) have 0% of their investors’ money in gold.

We’d like to pause here with a shout out to Warren Buffet and his Side-Kick Mr. Magoo who have been bashing gold for more than a decade by asking:

“Hey, Uncle Warren! How much Gold have you and Charlie Munger accumulated?”

So, for now we will remind you that almost everyone we talk with says the same thing about gold.

And that is how every time they thought about buying gold/gold stocks (and didn’t) they all regret not doing it.

Don’t be one of them.

Instead read our October issue of “Simplifying Wall Street, In Plain English” (HERE) where we list all the gold stocks we have recommended…and where we see them going from here.

Share this with a friend…especially if they’ve been thinking about buying gold/gold stocks for years and are regretting not doing it. They’ll thank YOU later.

And tell them: