Most investors are so naïve that they think the Megabank Demons from 2008 somehow magically disappeared.

But they didn’t…they never went away.

And they are about to raise their ugly head again as the FED hints at lowering interest rates.

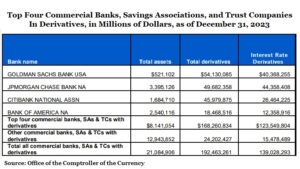

But it’s far more complicated than you might think…see chart below.

As indicated on the above graph, as of December 31, 2023, Goldman Sachs Bank USA, JPMorgan Chase Bank N.A., Citigroup’s Citibank and Bank of America held a staggering total of $168.26 trillion in derivatives out of a total of $192.46 trillion at all federally-insured U.S. banks, savings associations, and trust companies.

Look at that number spelled out $192,460,000,000,000.

That’s a lot of Demons.

And for the sake of clarity, let’s further define those Demons “In Plain English”

- Leverage

- Off-Balance Sheet Debt

- Over $192 Trillion in Derivatives

- Shaky Capital Levels

Derivative Demons on Steroids

Let’s start with Leverage…

As one example of the insane level of leverage concentrated in a handful of megabanks, look at the entry in the above chart for Goldman Sachs Bank USA.

As a “federally-insured bank,” part of the international trading conglomerate known as Goldman Sachs Group, they are allowed by its federal regulators to have $521 billion in assets but $54 trillion in derivatives.

But don’t worry.

Under U.S. accounting rules, these derivatives can be whittled down under the magic known as “netting,” and conveniently moved out-of-sight/out-of-mind off the balance sheet.

But that does not mean they don’t exist.

And speaking of leverage…

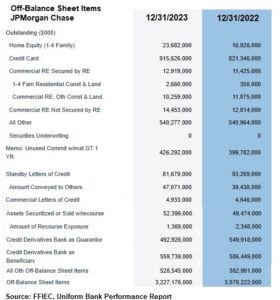

The chart below shows the stunning breakdown of the $3.2 trillion JPMorgan Chase is holding off-balance sheet according to data at the FFIEC (Federal Financial Institutions Examination Council).

JPMorgan Chase’s off-balance sheet hubris goes a long way in explaining why the banking federal regulators are demanding that it increase its capital by 25 percent.

Keep in mind these assets are “Off-balance sheet items.”

And in their typical arrogant fashion, their response to regulator demands to curtail their risk was to go on the offensive through its lobbying groups and threaten to sue its federal bank regulators.

Last week, Bloomberg News reported that JPM CEO Jamine Dimon and other megabank CEOs had huddled in private with Jerome Powell, Chair of the Federal Reserve, on July 19 in an effort to weaken the proposed increases in the capital rule.

Hmmmm!

What could they possibly be afraid of?

Any way you shake it, the Demons within the Megabanks are a bigger problem than they were in 2008.

But we’re not saying you should dump your banking stocks….

Wait!

Yes, we are…kinda, sorta.

And as we have been saying you should take some profits off the table before the election.

Why?

Because The Markets Don’t Like Uncertainty.

Be sure to read how to play the uncertainty factor in our September issue of “…In Plain English” (HERE).

Share this with a friend…especially if they own a lot of banking stocks. They’ll thank YOU later.

And tell them:

We’re Not Just About Finance

But we use finance to give you hope.

************************************