In the past, we have written numerous articles on why we hate ETF’s and mutual funds.

And here is a link to some of them.

READ: Diversification or ETF’d to Death (HERE)

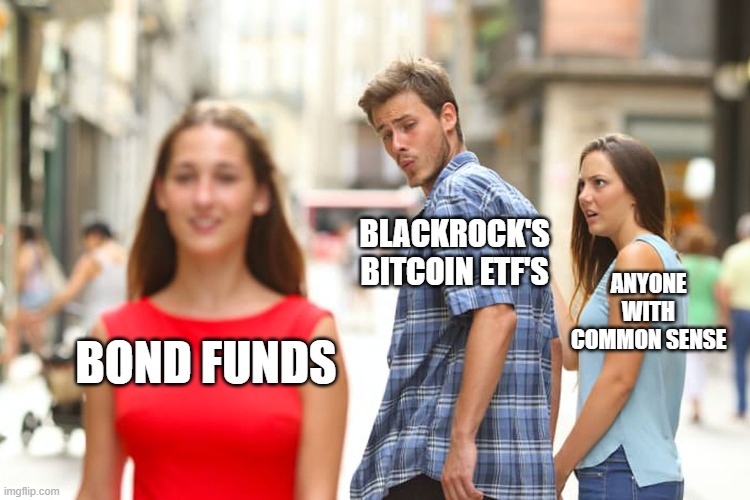

But our disdain just got worse with Blackrock’s announcement the they are adding their own Bitcoin ETF to their Income and Bond Funds.

Wait, What?

Aren’t bond funds supposed to pay a modest income and conserve your principal without much volatility?

Not anymore!

And adding Bitcoin volatility will certainly spice up what used to be a safe investment.

Ironically (or NOT) it flies in the face of everything a bond fund is supposed to represent.

Example: Bitcoin has zero backing, zero intrinsic value and is 100% Surveilled by the Boyz of the Deep State.

And now Blackrock is diving into Bitcoin ETF’s like a Wall Street shark smelling blood in the water.

We’re not exaggerating when we say how this is just another maneuver by the financial elite (Boyz in the “Club”) to centralize control under the guise of “Diversification.”

READ: Diversification = The Worst Word in Finance December 6, 2022 (HERE).

These Bitcoin ETF/bond funds mergers remind me of the synthetic CDO’s (Collateralized Debt Obligations) that nearly brought down the financial world in 2008-2009… (Thanks mostly to Goldman Sachs/AIG).

But unlike CDO’s money does not go into or out of Bitcoin.

Huh?

We could argue that it is a zero-sum Ponzi scheme.

And its price is just a measure of how much wealth one wants to transfer to another person already playing in the game.

When no one wants to play anymore, its price will be zero.

It is the largest, most extraordinary game of financial chicken the world has ever seen.

More Reasons to Hate ETF’s

The fact that Blackrock is loading up bond funds with their Bitcoin ETF’s is almost as sinister as their planned rape and pillage of Ukraine with their Ukraine Infrastructure Fund. And How Ukraine Was Sold to Blackrock (Read it HERE)

And in case you missed it…

We see this as just another pump and dump scheme to sucker in the BTC crowd before they get caught holding the bag of air they paid for with their tens (or hundreds) of thousands of dollars for.

Because when the price of Bitcoin goes to zero (or you can’t access your money) there will be no tidal wave of money coming out.

It will simply be that the wealth transfer is over.

And the folks holding the bag will have nothing because they will already be out of the game.

Ironically (or NOT) the timing of this Bitcoin/Bond Fund merger lines up with the imminent Sovereign Debt Default to the point that the damage done will be lost in the shuffle.

Read more about it (HERE).

Bottom line, here?

Avoid the Bitcoin/Bond Fund (and Blackrock) like the plague.

Share this with a friend…especially if they own bond funds. They’ll thank YOU later.

And tell them: