Economic concerns over the FED’s monetary policies are being blamed on yesterday’s selloff.

LOL!

The Whores-of Babble-On presstitutes were having a field day blaming yesterday’s selloff on the FED.

C’MON, MAN!

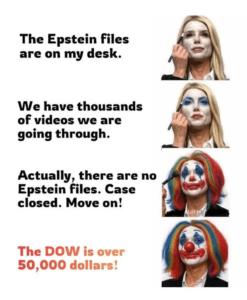

The “Look Here, Don’t Look There! tactic couldn’t be more obvious and yet the sheeple believe it.

YES, the CoronaFraud and Race Wars are grabbing all the headlines.

NO, we’re not all going to die from Race Wars or the Kung Flu.

What’s going on is the markets are signaling that it’s running out of gas and a pullback to test the lows is raising its ugly head.

If you’ve been reading us for a while, you’ll know we’ve been saying that the markets could re-test the March lows before the summer is over

Quite honestly, a correction at this time would be quite healthy for the stock market.

How much of a correction?

How about testing the 17,500 level?

Gasp!

If you didn’t take our advice in November, December and January about raising cash and having patience, you’d be wise to heed that same warning today.

You’re running out of chances.

What bothers me the most is how this will be somehow blamed on Trump in an attempt to derail his re-election.

Here’s what’s really going on behind the curtain. Wall Street knows the government is going to sell them out because of their insolvent pensions

Hence, a market selloff.

Tit for tat.

You must remember that the world sees us differently than we see ourselves.

The world sees Trump as the reason for the bull market.

If that changes, things could get ugly really quick.

In the meantime, don’t get fooled here. The real crisis is in the bond markets.

If you have raised cash, and feel you must buy something, put in your buy orders anywhere from 20-30% below today’s prices…and get ready to rock ‘n roll.

See our specific tips/recommendations in our June newsletter (HERE).