If you’ve been reading our posts for any length of time you know we are not big fans of the buy and hold strategy.

And to illustrate why, we present to you the Japan Nikkei Index currently trading at 39,553.

But what is interesting about the Nikkei is that it crossed the 39,000 level back in April this year.

So, why is that significant?

Glad you asked.

The last time the Nikkei was anywhere near 39,000 was in October of 1989 when it closed at 38,951.

A quick look down memory lane to 1989 reveals how Japan was buying everything in the world based on the strength of their dollar.

Do you remember all the marquise properties in New York city and famous golf courses that were being gobbled up by the Japanese back then?

Ironically (or NOT) in 1989 the USA markets were recovering from the 1987 meltdown when they fell over 22.5% in one day…all the way down to 1,738.

But by 1989 the DOW was all the way back up to a whopping 3,100 level.

And today the DOW is up to 44,293.

Buy and Hold Flaws

Based on the USA markets performance since 1989 you could make a case for the Buy and Hold strategy.

However, if you were unfortunate enough to buy the Nikkei Index back in 1989 (when everything looked perfect for Japan) then you might be nearing a break even point after 35 years of the Buy and Hold strategy.

And that’s just one of many reasons why we don’t care for the Buy and Hold strategy.

Another reason is factoring in the effect of inflation.

So, let’s do the math.

The average price of a car in 1989 was $12,000. Today it is $48,404.

The average price of a home in 1989 was $120,000. Today it is $420,400.

Conservatively speaking your dollar has lost approximately 65% of its purchasing power since 1989.

So, in real terms, if the value of a $10,000 investment in the Nikkei in 1989 is now worth $10,000, the purchasing power of that investment is only $3,500.

And even though the DOW beat the pants off the Nikkei, the adjusted for inflation value of $10,000 invested in the DOW in 1989 would be equal to approximately $25,427.

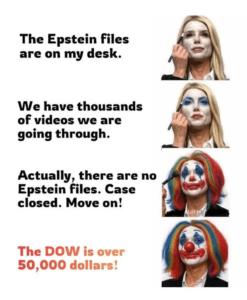

So, when you hear the Wall Street “Gurus” tout the buy and hold strategy, you would be wise to see how long THEY have employed the buy and hold strategy.

Chances are it is not as long as they would want you to believe.

Translation: You should not invest with the idea of “set it and forget it” mindset.

Volatility is moving up with the markets and you need to be more actively involved if you want to prosper AND thrive in Turbulent Times.

That’s why you need to read our November issue of “…In Plain English” (HERE).

Share this with a friend…especially if they bought and held the same stocks for decades. They’ll thank YOU later.

And tell them:

We’re Not Just About Finance

But we use finance to give you hope.

Support always welcome via the digital tip jar.

*****************************************