Yesterday we saw another all-time high for gold.

And one of the better headlines describing other market activity yesterday read: Bullion, Bitcoin, & Black Gold Bid As ‘Back To School’ Batters Bonds & Big-Tech Stocks.

Translation: We may just be seeing cracks in the armor of the Most Hated Bull Market in History.

READ: A Sadie Berger Moment in 2025? (HERE)

The $3,600 level on gold has been breached, setting the tone for $4,000 in the not-too-distant future.

And the gold bugs are partying like it’s 1999.

Why Gold Is Rallying

But Gold’s rally cannot be reduced to speculation about imminent rate cuts.

The evidence lies in its performance alongside rising long-term yields.

And investors are recognizing that rate cuts may arrive before inflation is contained, creating the conditions for higher long-term inflation and heavier debt burdens.

All-Time High

Gold is rising not because rates will fall, but because they are expected to fall too soon.

And Yield curve steepening (Credit Spreads) confirms this.

READ: What Are Credit Spreads? And Why You Should Watch Credit Spreads (Even If Most Don’t) (HERE)

And for all the Goldbugs (and Gold haters) out there, consider the following:

Gold Fact 1 – On 15 August, 1971, the USA stopped redeeming gold for $35.00 an oz.

The LBMA price was approximately $43.00 an ounce at that time.

Gold Fact 2 – As of Sep 2, 2025 the price of gold is approximately $3,600.00 an oz and has compounded at a rate of approximately 8.50% for approximately 54.05 years.

The dollar has lost approximately 7.83% per

annum for approximately 54.05 years against the dollar.

Gold Fact 3 – The dollar has lost approximately 98.78% of its value against gold since 15 Aug, 1971.

The dollar is now 1.22% of its value against gold.

Gold Fact 4 – Gold has beaten inflation by approximately 929% using data from the following site:

www.in2013dollars.com/us/inflation/1971

So, if gold continues its current average compounding rate of approximately 8.50% for another 5 years, then gold will be valued at approximately $5,305.00 an oz at this time in 2030. (((1.08497^5) × $3,530.00) = $5,307.17).

And if the same respective rates for inflation and gold continue for another five years from today then you will have beaten inflation by approximately 1,222%.

If this occurs then the dollar will have lost approximately 99.19% of its value against gold.

The dollar will then have only approximately 0.81% of its value against gold.

However, that’s a lot of IFS to consider.

In our opinion, the dollar will eventually be on its way to the dustbin of history like all the fiat currencies before.

And history proves it.

But…and this is a very VERY Big Butt…

As we have said in the past, before the fall, the dollar will rise to unimaginable heights…creating a path of destruction in its wake.

Learn how to position your portfolio against the dollar destruction AND see what gold stocks we still like in our upcoming September issue of: “Simplifying Wall Street…In Plain English” (HERE).

Share this with a friend…especially if they haven’t added any gold to their investments. They’ll thank YOU later.

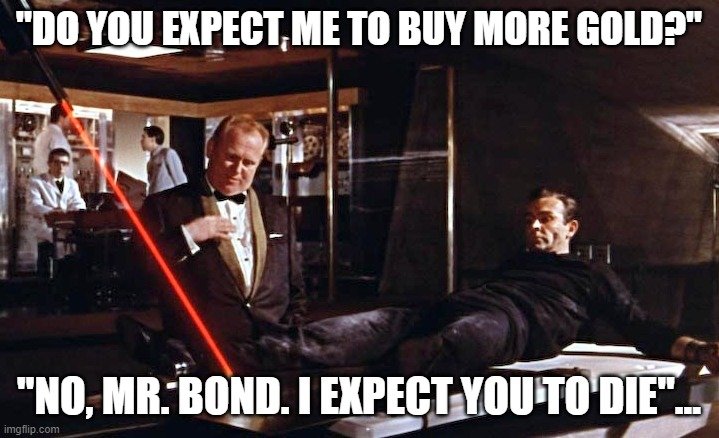

And tell them: