Everyone’s favorite uncle Warren “The little guy needs to buy ETF’s ‘cause I make a fortune off them” Buffet loves to promote ETF’s.

Why?

Here’s a guy who made his billions in the market by NOT buying ETF’s.

What he doesn’t tell you is that he owns large positions in companies that issue and trade ETF’s so it’s to his advantage to promote them to the little guy.

Shame on you, Uncle Warren.

You’re like every other Wall Street bankster who’s been in bed with DC for decades.

But that’s another story for another time.

By now you probably know that we hate most of the ETF’s that are shamelessly promoted to the “little guy.”

(If you want to know why, you can read our collection of articles on ETF’s HERE)

For the most part, we like owning stocks. More specifically large-cap brand name companies with a history of paying dividends.

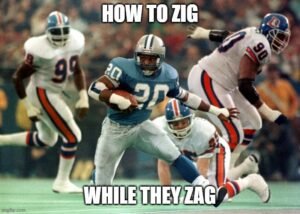

And for those who say, “yeah, but I can’t afford to buy lots of individual stocks,” we’ll recommend you consider one of our favorite strategies for small and large investors.

It’s called the “Dogs of the Dow” sometimes known as the Dow 10 portfolio.

Here’s the idea behind it.

You buy the 10 most out-of-favor stocks from the DOW 30, which are paying the highest dividends, and hold them for at least one year.

Then, based on their performance, rotate the portfolio based on how the other 20 stocks in the DOW have done.

In other words, you buy 10 of the big-name stocks that the majority of investors hate at that time.

History proves that this strategy out performs the indexes more than 85% of the time.

Compare that with Uncle Warren’s ETF’s.

And, the current yield on our latest selection of Dogs is over 3.4% compared to the DOW currently at 2.25% and S&P at 1.91%.

See our current recommendations for the 4th quarter (HERE).