Do you remember after the 2008 meltdown when many people said their 401k turned into a 201k? That alone is one reason why you should Hate mutual funds.

But it’s not the only one.

Please don’t misunderstand me here. I don’t hate all mutual funds…only most of them.

Why?

In a word?

Liquidity.

This became obvious back in October 1987 – the Big One – when the market fell over 22% in one day.

And considering how volatility can cause a 1,200-point drop today, it pales by comparison to the wreckage done on October 19, 1987.

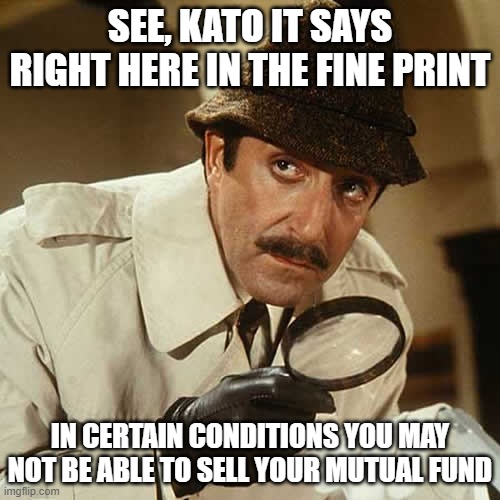

Not only did mutual funds get crushed back then, many investors were unable to sell their funds for up to two weeks later.

The reason given was to make sure the markets were “restored to an orderly fashion.”

That was total BS.

You see, back then – and even more so today – mutual funds can’t dump stocks without causing more damage to the prices.

Example: Let’s say a $150 Billion mutual fund has 2% of it’s money in one stock ($3 Billion dollars). And for some reason the stock has fallen out of favor and experienced a “nosebleed drop.”

(Cough! Like What Happened to Most tech stocks last year, Cough! Cough!)

The problem is the fund can’t just dump that stock without further crushing the price.

So, what do they do?

They sit on it and/or try to sell smaller increments to provide liquidity.

Hate Mutual Funds Liquidity

Oh, and about that liquidity issue. When investors want out of funds in large quantities, it forces the fund managers to sell stocks that they might not want to sell.

So, in a crazy falling market – and in order to raise cash – they’ll sell some of their winners while watching their losers go down even further.

Sorry, but that’s how it works.

Then they’ll play games by swapping some of their losers with other funds in their “family of funds.”

This allows them to hide losses in order to make it look like they had a good year.

Have you ever bought a fund in September or October and by December it’s down 5, 10, or even 15%?

And then you get a report that your fund had a capital gain causing you to pay taxes to Uncle Sam on an investment that’s down 10% or more.

Ouch!

Bottom line?

You don’t want to be near mutual funds in a declining market.

So, what’s the solution?

Find the answers in our “Short and Sweet Tips” column in our June newsletter (HERE).

Share this with a friend…especially if they own Tech Funds.

They’ll thank YOU later.

We’re Not Just About Finance

But we use finance to give you hope.

*************************************

|

|

You are receiving this email because you opted in via our website.