In case you missed it, last week Silicon Valley Bank (SVB) was a victim of a bank run.

Ironically (or NOT) the bank run was accelerated by JP Morgan, most likely sending a message to the smaller regional banks.

Huh?

And that message being “We – Major Banks – are going to crush you before we get crushed by the Sovereign Debt Crisis.”

As of December 31, Silicon Valley Bank had $209 billion in assets and $175 billion in total deposits, making it the second largest bank failure in U.S. history.

The largest being Washington Mutual which failed in September 2008 during the Wall Street financial crisis.

According to SEC filings, more than $150 billion of Silicon Valley Bank’s deposits were uninsured, leaving hundreds of the tech startup companies it served unsure of how to make payroll next week.

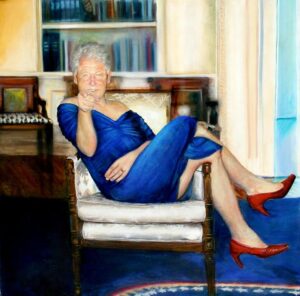

Translation: Most of the “Woke/Inclusive/Diversity” start-up companies borrowing from SVB are screwed.

This confirms that between the Biden administration and SVB we’ve all learned that the key to success is inclusion and diversity.

But only if your actual intention is to fail.

And it should come as no surprise that Wall Street’s #1 Court Jester, Jim Cramer, was pushing viewers to “Buy Silicon Valley Bank.”

This is reminiscent of him pounding the table for investors to “BUY BEAR STEARNS” weeks before they went belly up.

Ironically (or NOT) Bear was assassinated by JP Morgan as well…along with Lehman Brothers in 2008.

READ: Banksters, Wars, Bitcoin, Corruption and Vengeance February 8, 2022.

Not to be outdone by a clown like Cramer, Forbes Magazine (another bought-and-paid-for Wall Street publication) had this to say about SVB…

Bank Run or The Scent of Contagion?

So, whenever you see a “Bank Run” at a supposedly safe bank, the question becomes “How could this happen?”

In a nutshell, it all comes down to survival of the fittest as the banks know that ‘contagion’ is spreading…thanks to the Sovereign Debt Crisis…and they’re running for cover.

READ: Why Banks Don’t Trust Banks? February 2022

READ: $280 Trillion Debt for the Global Reset November 30, 2020.

And as they run for cover, they’ll use their default sayings like: “Who could’ve foreseen this happening? I’m shocked, I tell you shocked.”

And in response, the District of Caligula will say: “We need to form a committee to get to the bottom of this.”

Unfortunately, the committee will consist of the same cronies that created this monster of debt that we’re seeing implode.

So, what can you do about it?

Read the March edition of “…In Plain English” (HERE) for simple and easy solutions to protect your investments.

And share this with a friend…especially if they don’t know what a Bank Run or Contagion is.

They’ll thank YOU later.

Remember: We’re Not Just About Finance

But we use finance to give you hope.

*******************************

|

|

You are receiving this email because you opted in via our website.