US stocks fell on Tuesday as investors await the release of the CPI (key inflation numbers) which we believe are outright lies.

Unfortunately, those numbers are seen as key to the path of interest rates.

We say “unfortunately” because everyone is expecting the FED to cut rates again in December,

And, if for some reason, the FED does not cut rates then stocks could be in for a clobbering.

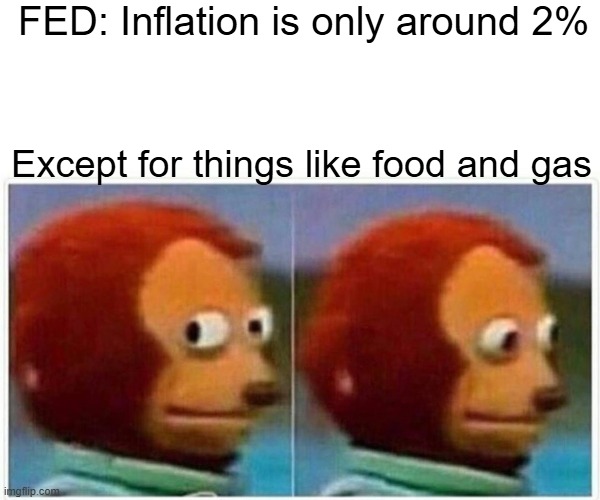

Keep in mind that the FED uses the inflation numbers determined by their “CORE” basis, which eliminates food and energy prices.

Question: How many people bought more food, gasoline, and used utilities last week compared to how many bought automobiles, computers, or big-ticket items?

Get my drift?

And – by the way – the food and energy used by everyone in the last week, month, years is waaaaayyyyy more expensive than the 2% inflation figure they try to shove down our throats.

But for some reason, the Boyz want everyone to think that inflation is under control and coming down.

Maybe it’s because they try and compare today’s inflation numbers with the peak of 9% in 2022.

Or maybe the FED is looking for an excuse to raise rates.

READ: When Has Lowering Rates Ever Worked? March 29, 2021 (HERE)

Or Maybe, JUST MAYBE, the Boyz in the “Club” are looking for an excuse for the market to crash before Trump takes over so they can fill their Christmas shopping lists at a discount while most investors are busy with the holidays.

Outright Lies

Suffice it to say that the FED can use today’s CPI report to play with the numbers in their favor, of course.

And they will justify their actions saying something like how “this now becomes another significant milestone in the policy-adjustment calculus.”

Translation: The policy-adjustment calculus means they can change figures to meet any criteria that will benefit them, but not you.

At the same time, it keeps investors from seeing how their plan becomes a massive distortion in the price action of assets.

That can be very dangerous and opportunistic at the same time.

And in today’s market that translates into opportunities in the Commodities Sector (gold, silver, corn, wheat, copper, etc.).

And that is exactly why we have been hollering how we are in the early stages of a major bull market in commodities.

So, regardless of how you feel about Key Inflation Numbers (CPI), it’s time to shift some of your assets into commodities.

Read our upcoming December issue of “…In Plain English” (HERE) for suggestions.

And share this with a friend…especially if they believe that inflation is under control. They’ll thank YOU later.

And tell them:

We’re Not Just About Finance

But we use finance to give you hope.

Support always welcome via the digital tip jar.

*****************************************