It wasn’t that long ago (2008) when we were told that the Big Banks in America were Too Big to Fail (TBTF).

Unfortunately, we the taxpayers had to bail them out.

Ironically (or NOT) some things never change.

Cue up: Blackrock Financial (BLK on the NYSE) …the world’s largest asset management firm.

It’s not well known but BLK – with over $10 Trillion under management – is following Klaus Schwab’s Agenda 2030.

Wait! What?

Blackrock CEO Larry Fink states:

“I write these letters as a fiduciary for our clients who entrust us to manage their assets – to highlight the themes that I believe are vital to driving durable long-term returns and to helping them reach their goals.”

Translation: typical CEO bulls**t rhetoric to sound as if they care about you.

Trust me…they don’t.

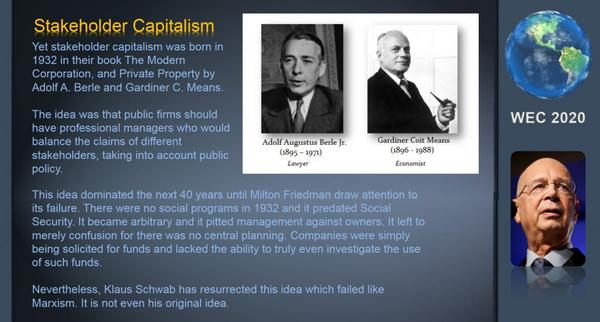

But Fink went on to say that one of his focus “themes” was to be based on “the foundation of stakeholder capitalism.”

Stakeholder capitalism is not about politics. It is not a social or ideological agenda. It is not “woke.” It is capitalism, driven by mutually beneficial relationships between you and the employees, customers, …

However, Fink failed to mention that the resurrection of “Stakeholder Capitalism” is Klaus Schwab’s idea.

And it originated in 1932 but failed along with Marxism AND led to the worst economic performance in history.

Wait! What?

See Below

Becoming Too Big to Fail

Very few people realize that BLK has been using client’s funds to buy up houses all over the country.

And paying cash for them.

And typically, 20% over the asking price.

Unfortunately for homebuyers, Fink/Blackrock has been competing with middle-class Americans for homes.

But the average American has virtually no chance of winning a home over Blackrock

Oddly enough this is in line with Schwab’s 2030 Agenda – “you will own nothing and be happy.”

But what happens if we suddenly have a “Liquidity Crisis?”

(Read: It’s Dead, Let’s Get Out NOW HERE) liquidity crisis

A crisis in liquidity could easily arise forcing BLK to dump shares.

Do the math.

A $10 Trillion portfolio poses an equal and serious risk to the world economy…especially during a liquidity crisis.

Meanwhile financial presstitutes continue to scare everyone into thinking the stock markets will collapse.

As a result, most investors continue to ignore the Sovereign Debt Crisis * we’ve been ranting about since 2018.

(* Read: Bond Market Tremors = Why Banks Don’t Trust Banks HERE.)

And it’s all part of the “Look Here, Don’t Look There” tactics used by the Wall Street Boys to pick your pocket when you least expect it.

So, keep your eyes on interest rates.

And learn how to prosper AND thrive when companies like BLK become Too Big To Fail in our March newsletter (HERE).

Share this with a friend…especially if they got burned in the 2008 meltdown.

They’ll thank YOU later.

We’re Not Just About Finance.

**********************************