With only 11 days until we experience the most hyped election in history, it is best to avoid election sensitive stocks.

Because trying to guess who will win and how it will affect markets is a waste of time.

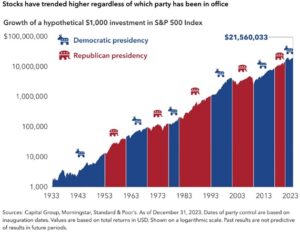

We looked back as far as 1897, and one thing is crystal clear:

There is no magical, predictable pattern when it comes to presidents and the stock market.

Because stocks have soared when both Republicans and Democrats were in power.

And stocks have tanked when both Republicans and Democrats were in power.

However, stocks usually rise regardless of who controls the White House.

Check out the chart below.

And that’s not because markets “only go up.”

But it’s because American businesses are moneymaking machines, which drives stock prices higher.

In the meantime, the Presstitutes are going out of their way bombarding you with noise and distractions about Trump this…Kamala that, etc.

And their noise may lead you to buying Politically sensitive stocks.

Buying Election Sensitive Stocks

Ironically (or NOT) there are companies that either soar or crater based on who sits in the White House.

Example: do you remember when Obama signed laws restricting gun sales?

It turned out he was the best gun salesman in America for six years running.

Firearms company Sturm Ruger & Co. (RGR) surged 1,300% after Obama’s election.

And when Trump won in 2016, he promised to rebuild the US military. That lit a fire under the largest defense contractor, Boeing Co. (BA)

Not surprisingly, when Biden was elected placed as president in 2020, everyone was screaming, “Buy pot stocks!”

Because his administration was going to loosen regulations. People expected more and more US states would legalize recreational marijuana.

And today, many of the hyped marijuana stocks (Tilray Brands (TLRY), Canopy Growth Corp. (CGC), or Aurora Cannabis (ACB) are down over 90%.

In short, some companies live and die on election results and narratives.

Why?

Because buying these types of stocks is like flipping a coin.

And Wall Street loves it when you do.

It’s how they get you to zig while they zag.

Don’t take the bait.

Instead, stick with companies that not only weather major storms but also are in demand when the world gets crazy.

In our October Short and Sweet Tips column we listed 5 companies from the agricultural/food sector that come into play as food shortages become more obvious.

And for the time being we are staying away from the Tech Sector with one exception…

Read about it (HERE).

Share this with a friend…especially if they thought buying “Pot Stocks” was a good idea. They’ll thank YOU later.

And tell them:

We’re Not Just About Finance

But we use finance to give you hope.

Support always welcome via the digital tip jar.

*****************************************