With bank failures in the news, confidence in government is wavering bigly…and regardless of facts, perception and reality aren’t the same.

We’ve written numerous articles on confidence in government – or lack thereof – …HERE, HERE, HERE, and HERE.

And we constantly remind you that confidence always outweighs reality.

In other words, it’s basically what you believe to be true is true.

Unfortunately, most people’s perception is often wrong…especially when it comes to the markets.

Example:

There have been all sorts of studies on fundamentals that say if interest rates go up, stocks go down.

It’s not true.

Why?

- Because the stock market has never peaked with interest rates twice in history.

- If you think you are going to make 25% in the market, you’ll pay 10% interest

- But if you really think the market is only going to go up 10%, you won’t pay 10%.

- So, it’s always the difference between what you believe and reality.

History, Confidence, Perception and Reality

History proves that all empires eventually collapse under the weight of their own debt.

READ: History Repeats Because Human Nature Doesn’t Change March 16, 2019

And once the government accumulates enormous debt, it targets its citizens aggressively.

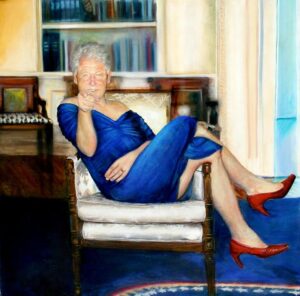

That is what we are seeing today with the antics from the District of Caligula regarding honoring deposits at the SVB bank.

To think that the Neocons in DC would screw bank depositors – to the tune of OVER $150 Billion – is unimaginable.

And yet the fact that the Boyz were NOT going to cover all deposits reflects the truth in the collapse of confidence in government.

As a result, O’Biden’s Neocons unleashed a financial panic that won’t be resolved anytime soon.

Does that mean the markets are going to crash?

Nope.

In fact, when loss of confidence in governments accelerates – like now – smart money moves away from the public sector (Govt bonds) and into the private sector (Stocks, real estate, precious metals, collectibles, commodities, etc.).

This reinforces what we’ve been saying for years about how we’re still in The Most Hated Bull Market in History.

And that opportunities of a lifetime await those with ears to hear.

So, listen to what the markets are currently saying by reading our March issue of “…In Plain English” newsletter (HERE).

And share this with a friend…especially if they think – like the rest of the sheeple – that the markets are going to crash.

They’ll thank YOU later.

And Remember: We’re Not Just About Finance

But we use finance to give you hope.

***************************

|

|

You are receiving this email because you opted in via our website.