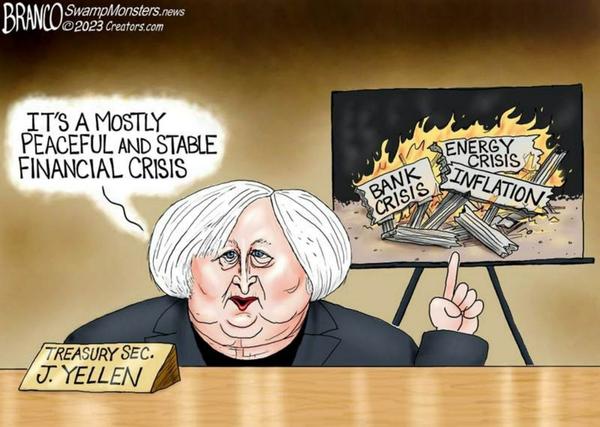

Don’t be fooled by puppets like Janet Yellen who say the banks are safe because the banking crisis is Far from over.

She also said that small depositors won’t be covered under FDIC insurance which sent the markets in a tailspin on Wednesday. (She quickly reversed her stance on Thursday)

But not only are the banks not safe, we believe we’re in the early stages of what will make the 2008 financial meltdown look like a walk in the park.

The reason???

In 2007-2009 the banks we’re overloaded with garbage Mortgage-Backed-Securities (MBS) and suffered huge losses because they couldn’t put a price * on them.

(* The financial world calls it mark to market)

Here’s a Reality check…NOTHING WAS FIXED back then.

Instead, the Boyz used a lot of band aids to make things look nicey-nice.

But the truth is the banks are still sitting on tons of toxic mortgages.

And since then, the FED has provided FREE money for the banks at historical lows…of which they’ve gorged themselves relentlessly.

So, look at the stupidity here.

Banks bought tons of long term bonds (at super low rates) so they could make loans at a much higher rate while screwing the consumer in the process.

But…and this is a very Big Butt…

The rate hikes – which coincidentally, or not, began after Russia invaded Ukraine – have crushed the value of their long-term bonds.

And guess what?

There are no buyers of size for those bonds.

Far From Over

Meanwhile, the Chinese are simultaneously dumping their Treasury bonds in record numbers.

Why?

They know the US is forcing WW3 via the proxy war in Ukraine.

And before a country gets into the war, they don’t want to be funding their adversary.

Why again?

The US can suspend payments on the bonds China (or anyone else) owns.

So now, the Banksters are looking at a double-edged sword swinging at them…with a fury.

READ: Why Banks Don’t Trust Banks February 24, 2020

So, comparing 2007-2009 to today we see where the crisis back then was based on fraud.

But today the debt is US Treasuries getting crushed by rising interest rates…in addition to bad mortgages.

They won’t go bankrupt but it is a major liquidity crisis.

And you must understand that this mess has unfolded because too many banks were wrapped up in the ‘WOKE’ culture.

As a result, they hired people who were UNQUALIFIED to run risk-management.

Sad to say this is what our current government has become.

So, if you believe the liars from the District of Caligula then you run the possibility of losing lots of money during this banking crisis.

Don’t take the “Banks are Safe” bait!

Instead, learn how to prosper AND thrive in Turbulent Times – and avoid losing to the Banksters – in our March newsletter (HERE).

And share this with a friend…especially if they keep lots of money in a bank.

They’ll thank YOU later.

Remember: We’re Not Just About Finance

But we use finance to give you hope.

*************************************

|

|

You are receiving this email because you opted in via our website.